|

Blog Feeds

Anti-Empire

Human Rights in IrelandPromoting Human Rights in Ireland

Lockdown Skeptics

Voltaire NetworkVoltaire, international edition

|

Zombie Housing, Zombie Banks, Zombie Governments: Economy Cassandra Says Marx was Right international |

anti-capitalism |

opinion/analysis international |

anti-capitalism |

opinion/analysis

Sunday August 21, 2011 17:18 Sunday August 21, 2011 17:18 by Roy Batty by Roy Batty roy at wheresmyfuckingmoney dot com roy at wheresmyfuckingmoney dot com

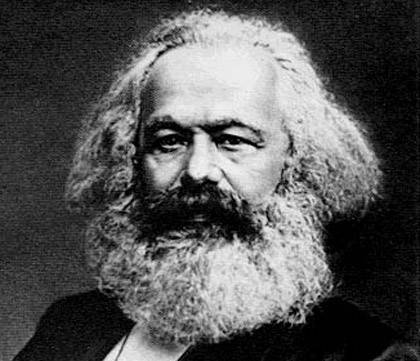

"Karl Marx had it right. At some point capitalism can destroy itself because you cannot keep on shifting income from labor to capital without not having excess capacity and a lack of aggregate demand, and that's what's happening." --Nouriel Roubini Economist Nouriel Roubini says the risk of a global recession is greater than 50 percent, and the next two to three months will reveal the economy's direction. The economist who predicted the financial meltdown in 2005 says Marx was correct that capitalism can collapse. Fortune Magazine: "In 2005 Roubini said home prices were riding a speculative wave that would soon sink the economy. Back then the professor was called a Cassandra. Now he's a sage." Paul Krugman (2009): "Nouriel Roubini was right. At a time when the likes of Alan Greenspan were dismissing concerns about excessive home prices and declaring that banks were stronger than ever, Roubini warned that there was a monstrous bubble in the housing market and that the bursting of that bubble would cause much of the financial system to collapse. And so it has turned out, with even the most seemingly outlandish of Roubini's predictions matched or even exceeded by reality." In a fascinating interview with The Wall Street Journal's Simon Constable, Dr. Roubini doesn't have much good to say about the future. In fact, his answer to Mr. Constable's first question, "What can we do to get the economy going?" is "Probably very little." See full article and video at http://wheresmyfuckingmoney.com/2011/08/zombie-housing-...ight/ |

printable version

printable version

Digg this

Digg this del.icio.us

del.icio.us Furl

Furl Reddit

Reddit Technorati

Technorati Facebook

Facebook Gab

Gab Twitter

Twitter

View Comments Titles Only

save preference

Comments (5 of 5)

Jump To Comment: 1 2 3 4 5The depth of the crisis and the true nature is beginning to sink in all around. First we were told it was just a recession and we would soon get back to growth, but this was always a lie, and clearly some of the clueless people in power believed this but there were others who did not.Just yesterday, the WSWS site carries a report on how things are spiralling out of control and it correctly identifies the problem and solution namely to get rid of the financial control of everything and replace it by democratic control.Here is an extract from the report which sums it up nicely

In 1991, when the Soviet Union was dismantled at the hands of the Stalinist regime, the demise of the USSR was proclaimed as proof that socialism had failed and the unrestricted capitalist market had triumphed.

The past three years had shattered these claims. The markets, and particularly the financial markets, have demonstrated their destructive power. Speculators are driving governments and dictating policies that plunge society into ruin and destroy the livelihoods of broad layers of the population.

The public purse is being looted in order to save the banks and the assets of the wealthy, while education, health and old age care are being destroyed and the youth pushed onto the streets with no prospects. One austerity measure follows the next, aggravating the recession, which in turn rips new holes in the public sector, creating a vicious circle with no way out.

Another analasis, this time from Eddie Ford. He examines the reasons for the US & World economic crisis. Full text at link

.Obviously, the decision by Standard and Poor’s on August 6 to issue a “negative” outlook on the United States government and hence downgrade its credit rating by one notch from triple-AAA to AA+ status was a political humiliation for the Obama administration. A humiliation doubtlessly compounded by the finger-wagging it received from the Chinese bureaucracy, which hypocritically lectured the US about its “debt addiction” - a bit like a drug-dealer scolding a user for having a bad habit.This was the first time, of course, that S&P has ever made such a judgement since it first began rating the credit-worthiness of US railroad bonds in 1860 and it has indicated that another downgrade is possible within the next 12-18 months. Which would trigger another around of economic and political panic as sure as night follows day. There is also the real possibility that other credit rating agencies will follow suit.

The rating agencies OK'd and A-rated the sub-prime bundled-derivative scam all the way to the big bust. Michael Lewis's 'The Big short',Penguin, 2010, gives an insider's scope on the strokes. In fact, the rating agencies are central to the mega-rip.

This morning's dispatch http://www.globalresearch.ca/index.php?context=va&aid=26088

The point of all Hudson's articles is 'Financhial capital bad, industrial capital good' but good for who, that is the question. Although it is obvious that financhial capital has and is running amok all over the world are the sweatshops of industrial capital any better. Hudson is one of these commentators who are ex system, he was a former advisor during Regan's time. He does accurately describe the racket that countries like Latvia and Greece face and Ireland too if the state continues in the current direction, but we need more than what his analysis boils down to which is the 'Good cop, Bad cop' choice.